Beyond Transactions

The Strategic Intersection of Technology, Finance, and Society.

The primary goal of the project is to establish Yape as an essential element of people's daily routines, evolving into an everyday infrastructure that plays a substantial role in streamlining and enhancing their lives.

In recent years, digital channels have revolutionized how consumers in Peru interact with financial services, driving business growth and financial inclusion. A study by Ipsos shows that digital wallet usage in Peru and other countries has more than doubled within a year. Leading this change is Yape, a mobile app offering a variety of financial services, from payments to investments. While Yape has made strides in financial empowerment, it faces challenges in technology adoption and security as it aims to become a cornerstone in the financial journeys of individuals and businesses.

-

Ruhi Dholakia

Snehal Khatavkar

Steven Hunsicker -

Mariela Sotomayor

Juan Francisco Cabana

Tomas Nalda

Partners

Credicorp is the leading financial services holding company in Peru, with a presence in Colombia, Bolivia, Chile, Panama, and the United States. It currently has consolidated universal banking insurance and pension platforms that serve all segments of the Peruvian population, complemented by a significant presence in microfinance, investment banking, and wealth management in Latin America.

Yape is a payment platform leveraging financial transactions for both individuals and businesses. It is a solution to address the challenges of a straightforward, rapid, and secure method of monetory transactions. It uses the cell phone number in your contacts, or a QR code of Yape, Visa, or Izipay. It is the most used app in Peru. As of 2023, Yape has played a pivotal role in promoting financial inclusion by extending its services to over 2.5 million Peruvians.

Benefits of digital finance in everyday life.

Convenience &

Accessibility

Instant transfers between individuals regardless of location.

Cashless purchases enhance user experience.

Lower

Transaction Costs

Digital platforms incur lower fees than traditional banking.

Efficiency from reduced physical infrastructure and intermediaries.

Enhanced Security &

Traceability

Advanced security features like encryption & two-factor authentication.

Digital trails allow for easy tracking of personal spending & merchant sales management.

Digital financial infrastructure has also enabled Yape to facilitate P2P money transfer between friends.

Digital finance infrastructure has enabled Yape to facilitate P2M transactions between a small merchant and their customer.

Yape grew its business on P2P and P2M transactions.

Within these everyday transactions, a new paradigm has emerged.

Starbucks as Financial Instrument

Interest-Free Loan: Starbucks leverages $1.6 billion from customer cards/app balances without the regulatory constraints of traditional loans, enhancing financial flexibility.

Annual Breakage Income: This is the money that stays in accounts and is forgotten or unredeemed by customers.

Affirm as BNPL Service

Affirm provides point-of-sale financing and buy now, pay later (BNPL) services, constituting a form of lending.

Empowering customers, Affirm offers transparent and flexible installment plans with upfront disclosure of total costs, including any interest, for their purchases.

Robinhood as an Embedded Finance

Robinhood integrates embedded finance into financial services to broaden stock market access while creating revenue

Simplifies and secures transactions, empowering user financial management

Influences societal stock market engagement, altering investment culture

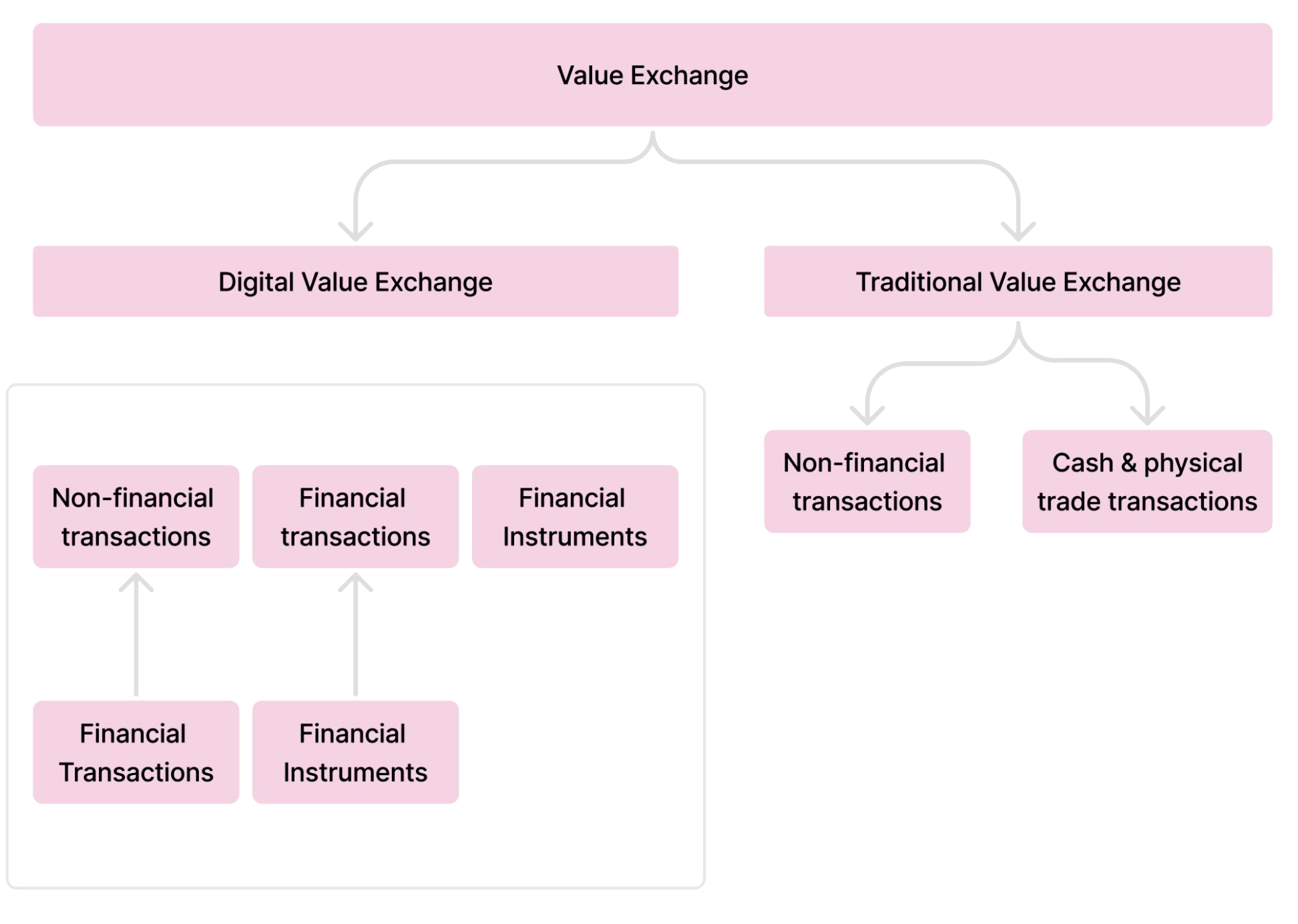

Embedded Finance

Embedded finance refers to the integration of financial services into non-financial companies' platforms or ecosystems.

This approach allows businesses that traditionally aren't in the banking or financial sector to offer financial products or services directly to their customers.

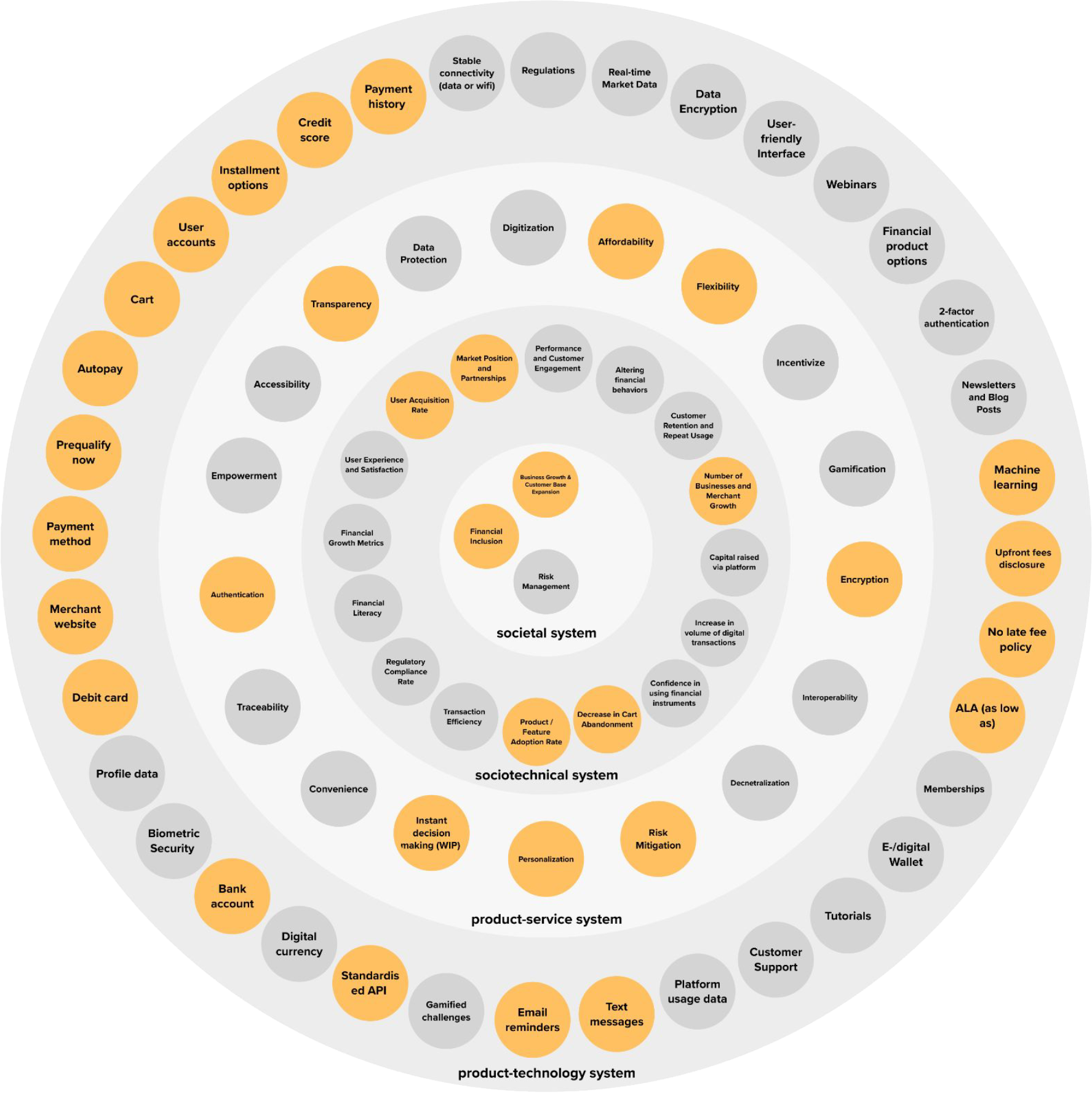

Where Yape Currently Stands

Yape occupies a small area in the digital financial services landscape.

Reframing;

Embedded Value Exchange

What if we could apply the principles of Embedded Finance to a broader spectrum of value?

Abstracted Embedded Finance: Elevates traditional embedded finance to encompass a spectrum of value exchanges in digital interactions.

Unified Value Interactions: Integrates financial, data, and experiential transactions, creating a seamless user journey.

Industry-Wide Relevance: Encourages financial and non-financial sectors to reconceptualize value creation and capture.

Future of Interaction: Envisions every user touchpoint as an opportunity for diverse value exchange, redefining industry innovation.

Starbucks

Customers: Loyalty, word-of-mouth marketing, money, data (through app usage, purchases, etc).

Starbucks: A place to socialize or work, a loyalty program, personalized promotions (via the Starbucks app), coffee and other beverages, and food.

Partners (Spotify, Doordash, Lyft): Usage of the service in exchange for stars, data

Affirm

Customers: Responsible credit limits, confidence in purchasing, potential for loans without extensive credit history

Merchants: Increased sales through access to confident, high-intent shoppers

Financial Institutions: Revenue through loan licensing agreements

Robinhood

Customers: Access to financial services and transactions, enhanced features and insights for Gold users

Robinhood: Financial compensation through transaction fees, subscriptions, interest on cash, and margin interest

EXAMPLES; Value Exchange:

Google Suite

Customers: Free access to a comprehensive suite of productivity and collaboration tools; storage space for personal use; integration with third-party applications.

Google: Collection of user data for improving algorithms and service personalization; user retention on the Google ecosystem; potential upsell of premium services.

Customers: A platform for sharing content, networking, and entertainment; opportunities for personal branding and business promotion.

Instagram: User engagement data for targeted advertising; content for platform vitality; brand partnerships and influencer marketing revenue.

Current Digital Financial Services Landscape

Venmo

Yape

Square

Paypal

Transactions

Robinhood

Brokers

Fidelity

Investments

Financial Instruments

Affirm

Starbucks

Robinhood

Klarna

Embedded Financial Instruments

Video game microtransactions

Uber’s in-app tips

Value Exchange

What if more than one financial service was embedded into a value exchange?

Provocations

Multi-Embedded Value Exchanges

How might multi-embedded value exchanges be used to engage multiple customers within the same transaction? i.e. What if one of the embedded value exchanges weren’t with the same end-user?

How might companies use multi-embedded value exchanges to create tiered service models, offering premium services or products to high-value customers?

How can multi-embedded value exchanges be used to automate and streamline B2B transactions, reducing overhead costs and increasing efficiency?

How might multi-embedded value exchanges be used to offer subscription-based models, ensuring a steady revenue stream?

What if companies used data from multi-embedded value exchanges to develop targeted marketing campaigns, upselling and cross-selling products based on customer's transaction history and preferences?

Scenario

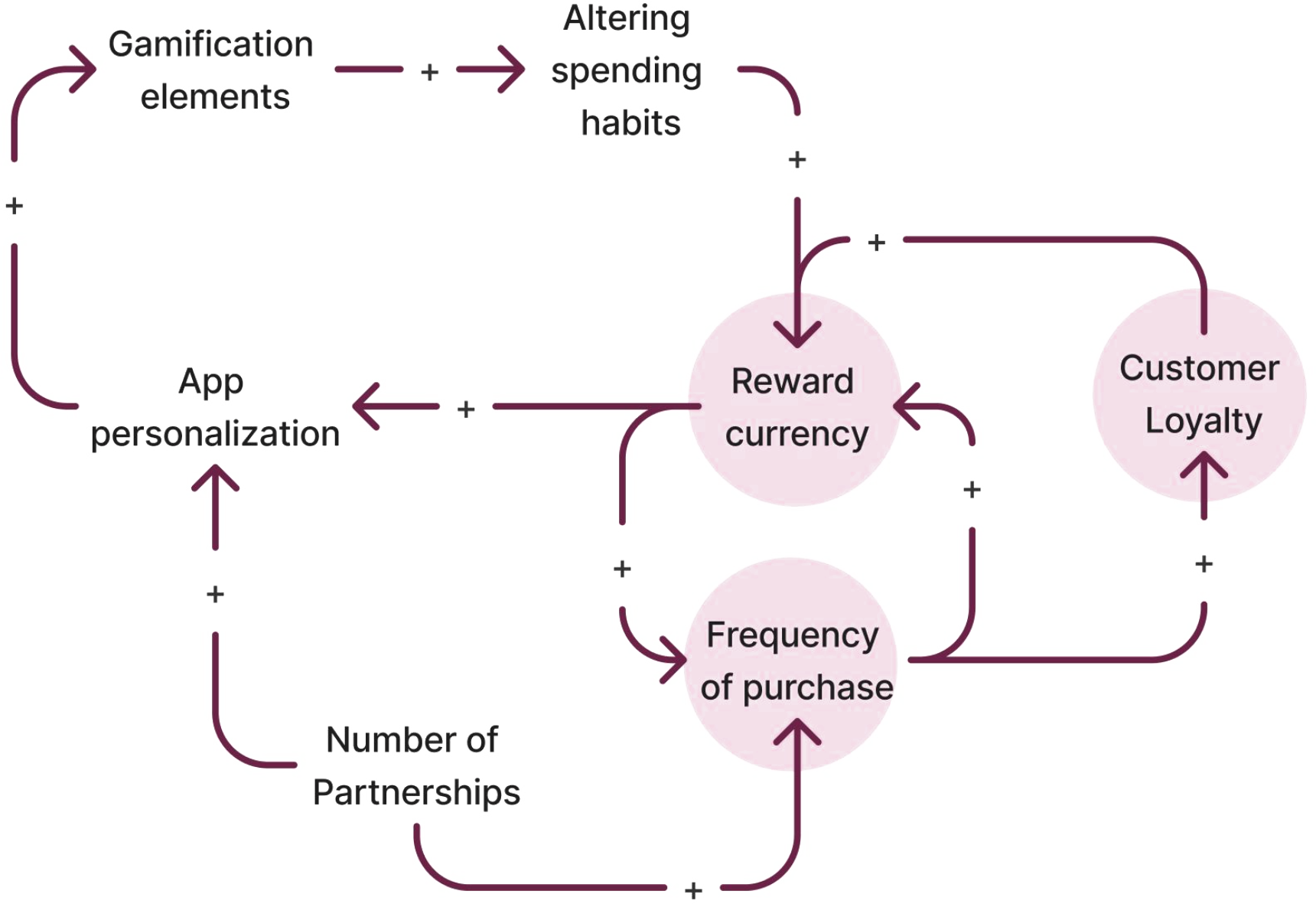

Starbucks

Reward system increasing loyalty

Interactive rewards influence customers to buy more frequently.

Customers adjust their spending to maximize reward currency benefits.

The reward system encourages regular purchases, boosting loyalty.

Affirm

Transparency increasing spending

BNPL options at checkout prompt increased consumer spending.

Transparency in interest rates and installment plans leads to confident budgeting, further incentivizing the use of BNPL services.

Revenue rises from merchant fees and loan interest tied to sales.

Robinhood

Trading & Embedded Finance fuels growth

No commission fees attract users, fueling rapid growth.

Revenue hinges on PFOF, which could affect trade quality and invite scrutiny.

Growth is checked by public opinion and regulatory oversight, impacting future expansion.

INEQUITIES

Unequal access widens the knowledge gap

Education level assumptions and privatization of educational resources create barriers, excluding certain segments from gaining essential financial knowledge and engagement.

Variances in technology understanding across demographics contribute to an asymmetry in comprehending financial decision impacts.

Biased algorithms widen the credit gap

Machine learning algorithms designed with traditional eligibility criterias exclude marginalised populations from accessing financial instruments that help in building credit

Non-transparent data trail may lead consumers to underestimate the potential risks associated with certain financial behaviors.

Value Exchanges for Profit and for Good

Provocations

What if companies reward consumers for increasing financial literacy?

How could marginalized populations actively contribute to building community-sourced emergency funds, expanding the concept of crowdsourcing to include community-level budgeting and savings?

How might the customization of financial profiles for individuals go beyond traditional criteria like income history and payroll, introducing a more nuanced and personalized approach?

What if we start rewarding a saving score along with a credit score to build financial resilience?

What if organisations thought of the financial knowledge of consumers as a currency?

Futurescape

Traditional Digital Finance

Simple Value Exchanges

Transactions

Financial Instruments

Embedded Value Exchanges

Simple Embedded Value Exchanges

Embedded Financial Instruments

Embedded Transactions

Multi-Embedded Value Exchanges

Yape’s New Position

From

High-growth organization facilitating transactions and entering embedded finance

Business Growth & Customer Base Expansion

Risk Management for profit

Financial Inclusion

To

High-growth organization driving profit and social innovation through all levels of value exchange, simple and embedded

Business Growth via customer empowerment

Risk Management for financial resilience in customers

Financial Inclusion

Wealth Building for individuals and communities